How and Where to Buy cVault.finance (CORE) – Detailed Guide

- What is CORE?

- Step 1: Register on Fiat-to-Crypto Exchange

- Step 2: Buy ETH with fiat money

- Step 3: Transfer ETH to an Altcoin Exchange

- Step 4: Deposit ETH to exchange

- Step 5: Trade CORE

- Last Step: Store CORE securely in hardware wallets

- Other useful tools for trading CORE

- Frequently Asked Questions

- Latest News for CORE

- CORE Price Prediction and Price Movement

What is CORE?

What Is cVault.finance (CORE)?

CVault.finance is a decentralized finance protocol with a deflationary governance token, CORE, that users can stake and use to yield farm. The platform also plans to introduce "Automated Strategy Vaults," which will allow for the automatic execution of profit-generating strategies for staked tokens.

Aiming to be completely decentralized, cVault.finance calls its governance model "the strongest and most involved in DeFi." CORE token holders vote as a community to implement changes to the protocol, including the creation of new liquidity pools or the elimination of existing ones.

The platform was launched on the Ethereum mainnet in September 2020, with CORE debuting on Uniswap seven days later.

Who Are the Founders of cVault.finance?

CVault.finance was launched in September 2020 by two pseudonymous developers known as "0xRevert" and "X 3." The two have a history of working in traditional software development, but cVault.finance is their first crypto-related project. The co-founders have stated that they decided to create the platform after witnessing DeFi yield farming operations "fantastically implode due to poor economic decisions" such as minting new tokens as part of the farming process.

In October 2020, cVault.finance brought on another pseudonymous individual, "0xdec4f," to join its leadership team as head of operations. Prior to assuming an official role with cVault.finance, 0xdec4f was an active community member and moderator of the platform's Telegram channel.

What Makes cVault.finance Unique?

The main way in which cVault.finance seeks to differentiate itself from other DeFi protocols is through its focus on deflationary yield farming. The project believes that minting new tokens to reward liquidity providers — a process carried out by many DeFi protocols — is unsustainable in the long term, as it devalues the token. It has referred to this form of incentivization as "flawed and short minded."

CVault.finance offers what it calls "deflationary farming" in which no new tokens are ever minted. Rather, a 1% fee is charged on token transfers, and the fees are used to reward liquidity providers. In addition, the protocol prevents the withdrawal of liquidity from Uniswap, which it says guarantees a stable market. These built-in measures, it argues, will ensure the sustainability of the platform.

The cVault.finance development team receives 7% of token transfer fees, while the remaining 93% is redistributed as rewards to liquidity providers.

Related Pages:

Learn more about UNI, the governance token of the Uniswap platform.

Learn about yearn.finance, a DeFi project that skyrocketed in popularity in 2020.

Interested in using Uniswap yourself? Read an in-depth guide on Alexandria, CoinMarketCap's online educational resource.

Stay up to date on DeFi, yield farming and more with the CoinMarketCap Blog.

How Many cVault.finance (CORE) Coins Are There in Circulation?

CVault.finance has a fixed supply of 10,000 tokens. All 10,000 CORE was minted in September 2020 during the project's initial seven-day "liquidity generation event," or LGE, during which participants contributed over 3,759 Ether (ETH) — valued at $1.41 million at the time — that was used to create a CORE/ETH Uniswap liquidity pool, with contributors receiving liquidity pool tokens. A second LGE was held in October 2020, this time accepting Wrapped Bitcoin (WBTC) and receiving over $5 million in value. The project plans to hold a third event centered around a stablecoin.

Unlike typical Uniswap pairs, these LP tokens cannot be redeemed for their underlying asset, thus permanently locking liquidity into the protocol. This has led to the creation of a secondary market where users trade LP tokens for other assets. The development team of cVault.finance has also stated that this results in a so-called "price floor," meaning that CORE can never drop below a certain price.

According to cVault.finance, the development team does not receive any CORE tokens as a part of its LGEs.

How Is the cVault.finance Network Secured?

CORE is an ERC-20 token — although it has proposed a new ERC-95 standard — meaning that it relies on the Ethereum blockchain to validate CORE transactions. Ethereum uses a proof-of-work consensus algorithm in which miners compete among each other to add new blocks to the blockchain and a majority of all nodes in the network must confirm a record for it to be posted.

According to co-founder X 3, because cVault.finance's liquidity generation events use open-source smart contracts and liquidity is permanently locked in Uniswap, there is no way for the developers to carry out a "rug-pulling" event in which the development team makes off with users' funds — thus making it more secure than other DeFi projects.

The project's smart contract was audited in October 2020 by blockchain software development and security consulting company The Arcadia Group. The firm found that while there were no critical security flaws that required immediate attention, there were some fixes that could be implemented to improve security.

The cVault.finance team also announced in October 2020 that it was offering a $50,000 bug bounty for community members who find flaws in its upcoming changes to its code.

Where Can You Buy cVault.finance (CORE)?

CORE is primarily exchanged on Uniswap (V2), although it is also listed on Bilaxy and Hotbit. It can be traded against Ether, WETH (WETH), Tether (USDT) and Bitcoin (BTC).

Are you interested in buying CORE or other cryptocurrencies such as BTC? CoinMarketCap has a simple, step-by-step guide to teach you all about crypto and how to buy your first coins.

CORE was first tradable on 30th Sep, 2020. It has a total supply of 10,000. As of right now CORE has a market capitalization of USD $66,074,903.06. The current price of CORE is $6607.49 and is ranked 343 on Coinmarketcap and has recently surged 217210.26 percent at the time of writing.

CORE has been listed on a number of crypto exchanges, unlike other main cryptocurrencies, it cannot be directly purchased with fiats money. However, You can still easily buy this coin by first buying Ethereum from any fiat-to-crypto exchanges and then transfer to the exchange that offers to trade this coin, in this guide article we will walk you through in detail the steps to buy CORE.

Step 1: Register on Fiat-to-Crypto Exchange

You will have to first buy one of the major cryptocurrencies, in this case, Ethereum (ETH). In this article we will walk you through in details two of the most commonly-used fiat-to-crypto exchanges, Uphold.com and Coinbase. Both exchanges have their own fee policies and other features that we will go through in detail. It is recommended that you try both of them and figure out the one that suits you best.

Select Fiat-to-Crypto Exchange for details:

- UpHold

Being one of the most popular and convenient fiat-to-crypto exchanges, UpHold has the following advantages:

- Easy to buy and trade among multiple assets, more than 50 and still adding

- Currently more than 7M users worldwide

- You can apply for UpHold Debit card where you can spend the crypto assets on your account like a normal debit card! (US only but will be in the UK later)

- Easy to use mobile app where you can withdraw fund to a bank or any other altcoin exchanges easily

- No hidden fees and any other account fees

- There are limited buy/sell orders for more advanced users

- You can easily set up recurring deposits for Dollar Cost Averaging (DCA) if you intend to hold cryptos long term

- USDT, which is one of the most popular USD-backed stablecoins (basically a crypto that is backed by real fiat money so they are less volatile and can be treated almost as the fiat money it's pegged with) is available, this is more convenient if the altcoin you intend to buy has only USDT trading pairs on the altcoin exchange so you don't have to go through another currency conversion while you buy the altcoin.

Type your email and click 'Next'. Make sure you provide your real name as UpHold will need it for account and identity verification. Choose a strong password so that your account isn't vulnerable to hackers.

You will receive a confirmation email. Open it and click on the link within. You will then be required to provide a valid mobile number to set up two-factor authentication (2FA), it is an extra layer to the security of your account and it is highly recommended that you keep this feature turned on.

Follow the next step to finish your identity verification. These steps are a bit daunting especially when you are waiting to buy an asset but just like any other financial institutions, UpHold is regulated in most countries such as the US, the UK and the EU. You can take this as a trade-off to using a trusted platform to make your first crypto purchase. Good news is that the whole so-called Know-Your-Customers (KYC) process is now fully automated and it shouldn't take more than 15 minutes to finish.

Step 2: Buy ETH with fiat money

Once you finished the KYC process. You will be asked to add a payment method. Here you can either choose to provide a credit/debit card or use a bank transfer. You may be charged higher fees depending on your credit card company and the volatile prices when using cards but you will also make an instant purchase. While a bank transfer will be cheaper but slower, depending on the country of your residence, some countries will offer instant cash deposit with low fees.

Now you are all set, on the 'Transact' screen under the 'From' field, select your fiat currency, and then on the 'To' field choose Ethereum, click preview to review your transaction and the click confirm if everything looks good... and congrats! You've just made your first crypto purchase.

Step 3: Transfer ETH to an Altcoin Exchange

But we are not done yet, since CORE is an altcoin we need to transfer our to an exchange that CORE can be traded. Below is a list of exchanges that offers to trade CORE in various market pairs, head to their websites and register for an account.

Once finished you will then need to deposit ETH to the exchange from UpHold. After the deposit is confirmed you may then purchase CORE from the exchange view.

Apart from the exchange(s) above, there are a few popular crypto exchanges where they have decent daily trading volumes and a huge user base. This will ensure you will be able to sell your coins at any time and the fees will usually be lower. It is suggested that you also register on these exchanges since once CORE gets listed there it will attract a large amount of trading volumes from the users there, that means you will be having some great trading opportunities!

Gate.io

Gate.io is an American cryptocurrency exchange that launched 2017. As the exchange is American, US-investors can of course trade here and we recommend US traders to sign up on this exchange. The exchange is available both in English and Chinese (the latter being very helpful for Chinese investors). Gate.io’s main selling factor is their wide selection of trading pairs. You can find most of the new altcoins here. Gate.io also demonstrates an impressive trading volume. It is almost every day one of the top 20 exchanges with the highest trading volume. The trading volume amounts to approx. USD 100 million on a daily basis. The top 10 trading pairs on Gate.io in terms of trading volume usually have USDT (Tether) as one part of the pair. So, to summarize the foregoing, Gate.io’s vast number of trading pairs and its extraordinary liquidity are both very impressive aspects of this exchange.

BitMart

BitMart is a crypto exchange from the Cayman Islands. It became available to the public in March 2018. BitMart has a truly impressive liquidity. At the time of the last update of this review (20 March 2020, right in the middle of the crisis with COVID-19), BitMart’s 24 hour trading volume was USD 1.8 billion. This amount placed BitMart on place no. 24 on Coinmarketcap’s the list of exchanges with the highest 24 hour trading volumes. Needless to say, if you start trading here, you will not have to worry about the order book being thin. Many exchanges does not allow investors from USA as customers. As far as we can tell, BitMart is not one of those exchanges. Any US-investors interested in trading here should in any event form their own opinion on any issues arising from their citizenship or residency.

Last Step: Store CORE securely in hardware wallets

Ledger Nano S

- Easy to set up and friendly interface

- Can be used on desktops and laptops

- Lightweight and Portable

- Support most blockchains and wide range of (ERC-20/BEP-20) tokens

- Multiple languages available

- Built by a well-established company found in 2014 with great chip security

- Affordable price

Ledger Nano X

- More powerful secure element chip (ST33) than Ledger Nano S

- Can be used on desktop or laptop, or even smartphone and tablet through Bluetooth integration

- Lightweight and Portable with built-in rechargeable battery

- Larger screen

- More storage space than Ledger Nano S

- Support most blockchains and wide range of (ERC-20/BEP-20) tokens

- Multiple languages available

- Built by a well-established company found in 2014 with great chip security

- Affordable price

If you are planning to keep("hodl" as some may say, basically misspelt "hold" which get popularised over time) your CORE for a considerable long time, you may want to explore ways of keeping it safe, although Binance is one of the safest cryptocurrency exchange there had been hacking incidents and funds were lost. Because of the very nature of the wallets in exchanges, they will be always online("Hot Wallets" as we call them), therefore exposing certain aspects of vulnerabilities. The safest way of storing your coins to date is always putting them into a type of "Cold Wallets", where the wallet will only have access to the blockchain(or simply "go online") when you send out funds, reducing the chances of hacking incidents. A paper wallet is a type of free cold wallet, it's basically an offline-generated pair of public and private address and you will have it written somewhere, and keep it safe. However, it is not durable and is susceptible to various hazards.

Hardware wallet here is definitely a better option of cold wallets. They are usually USB-enabled devices that store the key information of your wallet in a more durable way. They are built with military-level security and their firmware are constantly maintained by their manufacturers and thus extremely safe. Ledger Nano S and Ledger Nano X and are the most popular options in this category, these wallets cost around $50 to $100 depending on the features they are offering. If you are holding your assets these wallets are a good investment in our opinion.

Other useful tools for trading CORE

Encrypted Secure Connection

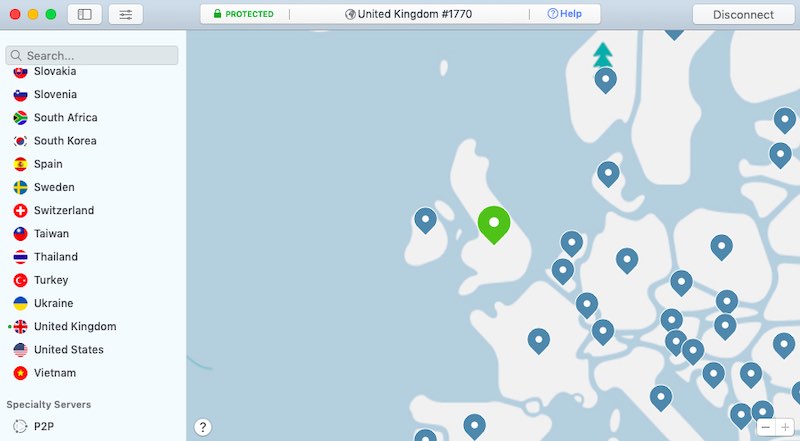

NordVPN

Because of the very nature of cryptocurrency – decentralised, it means that users are 100% responsible for handling their assets securely. While using hardware wallet allows you to store your cryptos in a safe place, using an encrypted VPN connection while you trade makes it harder for hackers to intercept or eavesdrop your sensitive information. Especially when you are trading on the go or in a public Wifi connection. NordVPN is one of the best paid (note: never use any free VPN services as they may sniff your data in return of free service) VPN services out there and it has been around for almost a decade. It offers military-grade encrypted connection and you can also opt-in to block malicious websites and ads with their CyberSec feature. You can choose to connect to 5000+ servers in 60+ countries base on your current location, which ensures you to always have a smooth and secure connection wherever you are. There is no bandwidth or data limits that means you can also use the service in your everyday routines such as streaming videos or downloading large files. Plus it is among the cheapest VPN services out there (only $3.49 per month).

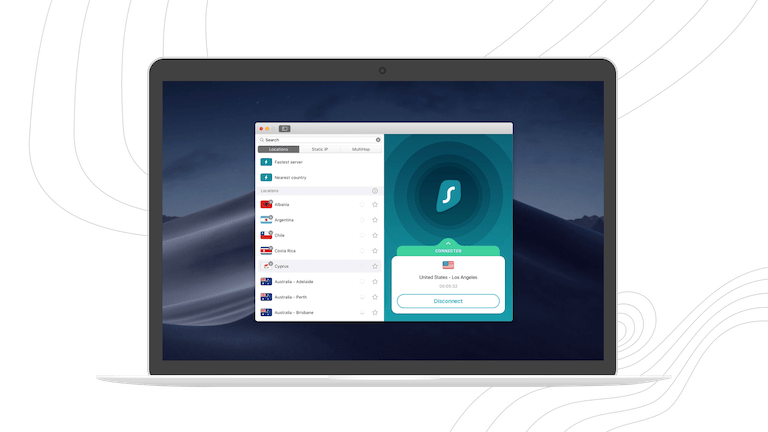

Surfshark

Surfshark is a much cheaper alternative if you are looking for a secure VPN connection. Although it’s a relatively new company, it has already 3200+ servers distributed in 65 countries. Apart from VPN it also has some other cool features including CleanWeb™, which actively blocks ads, trackers, malware and phishing attempts while you are surfing on your browser. Currently, Surfshark does not have any device limit so you can basically use it on as many devices as you want and even share the service with your friends and family. Use the signup link below to get an 81% discount(that’s a lot!!) at $2.49/month!

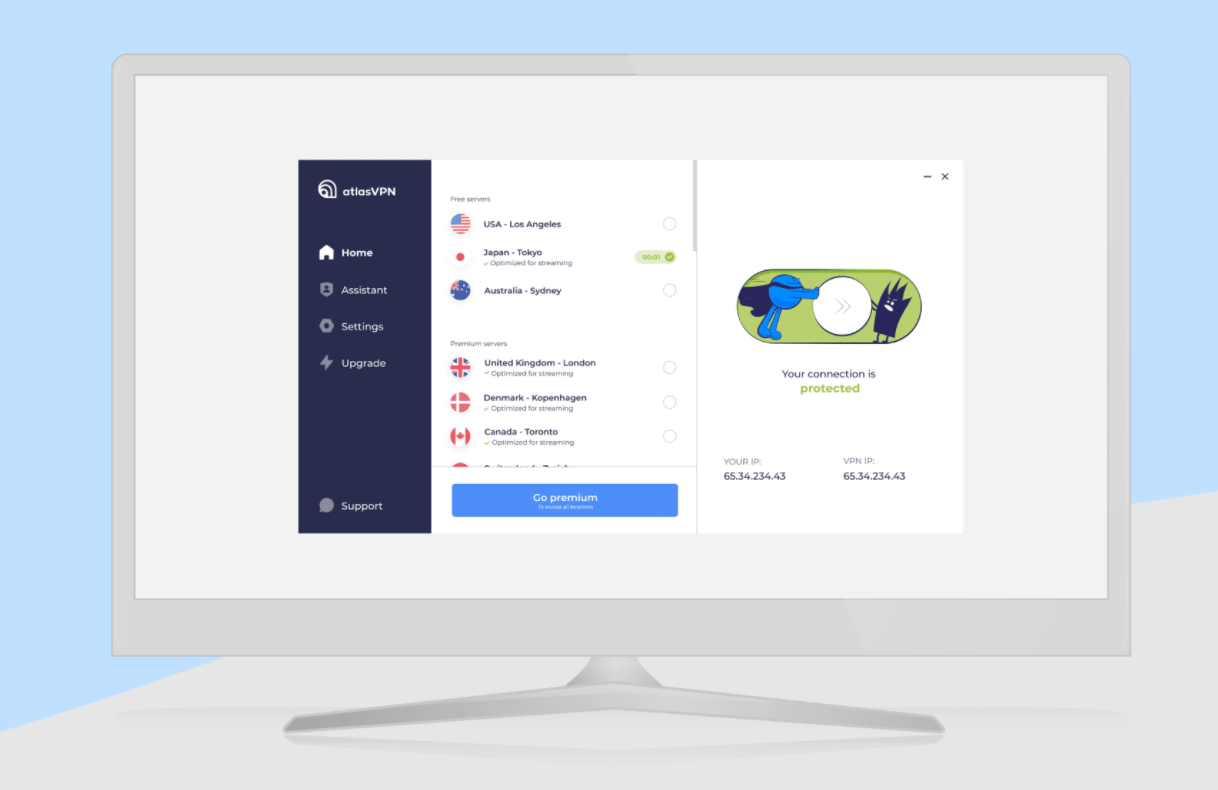

Atlas VPN

IT nomads created Atlas VPN after seeing a lack of top-notch service within the free VPNs field. Atlas VPN was designed for everyone to have free access to unrestricted content without any strings attached. Atlas VPN set out to be the first trustworthy free VPN armed with top-notch technology. Furthermore, even though Atlas VPN is the new kid on the block, their blog team’s reports have been covered by well-known outlets such as Forbes, Fox News, Washington Post, TechRadar and many others. Below are some of the feature highlights:

- Strong encryption

- Tracker blocker feature blocks dangerous websites, stops third-party cookies from tracking your browsing habits and prevents behavioural advertising.

- Data Breach Monitor finds out whether your personal data is safe.

- SafeSwap servers allow you to have many rotating IP addresses by connecting to a single server

- Best prices on the VPN market (only $1.39/month!!)

- No-log policy to keep your privacy safe

- Automatic Kill Switch to block your device or apps from accessing the internet if the connection fails

- Unlimited simultaneous connections.

- P2P support

Frequently Asked Questions

Can I buy CORE with cash?

There is no direct way to buy CORE with cash. However, you can use marketplaces such as LocalBitcoins to first purchase ETH, and finish the rest of the steps by transferring your ETH to respective AltCoin exchanges.

LocalBitcoins is a peer-to-peer Bitcoin exchange. It is a marketplace where users can buy and sell Bitcoins to and from each other. Users, called traders, create advertisements with the price and the payment method they want to offer. You can choose to buy from sellers from a certain nearby region on the platform. is after all a good place to go to buy Bitcoins when you can't find your desired payment methods anywhere else. But prices are usually higher on this platform and you have to do your due diligence to avoid getting scammed.

Are there any quick ways to buy CORE in Europe?

Yes, in fact, Europe is one of the easiest places to buy cryptos in general. There are even online banks which you can simply open an account and transfer money to exchanges such as Coinbase and Uphold.

Are there any alternative platforms to buy CORE or Bitcoin with credit cards?

Yes. is also a very easy to use platform for buying Bitcoin with credit cards. It is an instant cryptocurrency exchange that allows you to exchange crypto fast and buy it with a bank card. Its user interface is very easy to use and the buying steps are pretty self-explanatory.

Read more on cVault.finance's fundamentals and current price here.

CORE Price Prediction and Price Movement

CORE is up 10.41 percent over the last three months, while its market capitalization is still considered relatively small, which implies that the price of CORE can be very volatile comparing to those with larger market cap during big market moves. However, with a stead growth over the past three months, CORE has the potential to grow further and may yield some very decent gains. Again traders should remain cautious at all time.

Please note that this analysis is purely base on CORE's historic price actions and is by no means financial advice. Traders should always do their own research and be extra careful while investing in cryptocurrencies.